Masha Allah. This is the best news for Q1 end. At least I know with certaintly I´ll have a blast barito with my puts. Common earnings of $3.39 compared to expected $1.64. Alhamdulilah. All praises to Goldman Sachs, Lloyd C. Blankfein, Geithner, Summers and President Obama.

Goldman Sachs Sees Gold

Moderators: Moderators, Junior Moderators

Forum rules

This General Forum is for general discussions from daily chitchat to more serious discussions among Somalinet Forums members. Please do not use it as your Personal Message center (PM). If you want to contact a particular person or a group of people, please use the PM feature. If you want to contact the moderators, pls PM them. If you insist leaving a public message for the mods or other members, it will be deleted.

This General Forum is for general discussions from daily chitchat to more serious discussions among Somalinet Forums members. Please do not use it as your Personal Message center (PM). If you want to contact a particular person or a group of people, please use the PM feature. If you want to contact the moderators, pls PM them. If you insist leaving a public message for the mods or other members, it will be deleted.

- Aerosmith

- SomaliNet Heavyweight

- Posts: 1214

- Joined: Sun Sep 28, 2003 7:00 pm

- Location: Inside CFAI Publications

Goldman Sachs Sees Gold

http://bloomberg.com/apps/news?pid=2060 ... refer=home

Masha Allah. This is the best news for Q1 end. At least I know with certaintly I´ll have a blast barito with my puts. Common earnings of $3.39 compared to expected $1.64. Alhamdulilah. All praises to Goldman Sachs, Lloyd C. Blankfein, Geithner, Summers and President Obama.

Masha Allah. This is the best news for Q1 end. At least I know with certaintly I´ll have a blast barito with my puts. Common earnings of $3.39 compared to expected $1.64. Alhamdulilah. All praises to Goldman Sachs, Lloyd C. Blankfein, Geithner, Summers and President Obama.

- Voltage

- SomaliNet Super

- Posts: 29214

- Joined: Tue Oct 23, 2007 11:33 pm

- Location: Sheikh Voltage ibn Guleid-Shire al-Garbaharawi, Oil Baron

Re: Goldman Sachs Sees Gold

It is a black time for Republicans, extreme capitalists, and far right wingers. The time of ideology is done. It is time to stick with what works.

- Aerosmith

- SomaliNet Heavyweight

- Posts: 1214

- Joined: Sun Sep 28, 2003 7:00 pm

- Location: Inside CFAI Publications

Re: Goldman Sachs Sees Gold

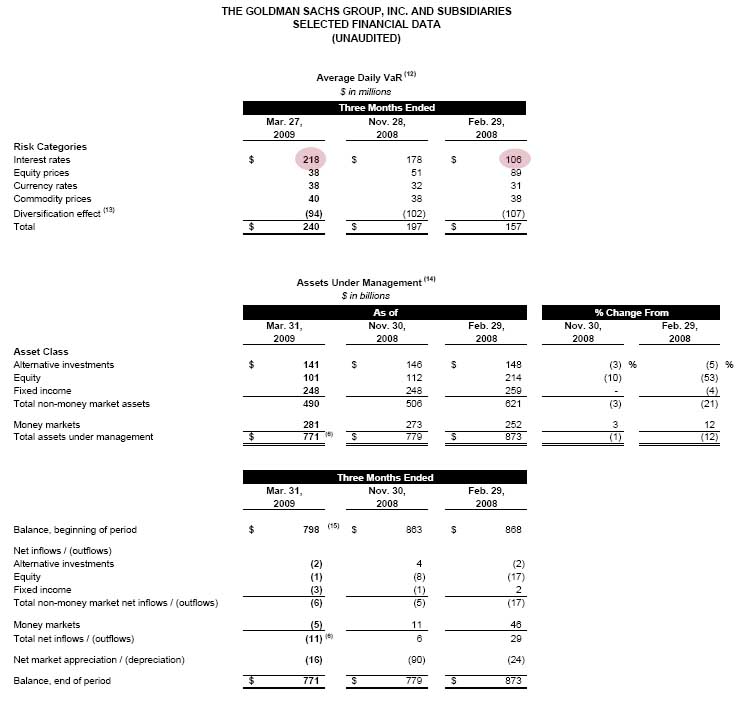

WTF happened to Goldman Sachs today. They had good VaR numbers and were very active in their trading desks from L1/2 feed. What the phuck happened, why 11% loss  ... So much for the 5billion common offerings and pretty boy Lloyd bringing some fresh tilapia. Nacalaa kutaal speculators

... So much for the 5billion common offerings and pretty boy Lloyd bringing some fresh tilapia. Nacalaa kutaal speculators

Anyone have a take on it.

Anyone have a take on it.

Re: Goldman Sachs Sees Gold

It's probably because of the fall in retail sales that were reported in the US but otherwise the announcement from GS has definitely helped the financial sector especially banks such as barclays in the UK and the FTSE also closed up according to the evening bulletin I got, so things are not looking too bad.

London

US sell-off causes jitters

Market Movers

techMARK 1,159.27 +0.02%

FTSE 100 3,988.99 +0.13%

FTSE 250 7,152.16 +2.48%

Miners and banks helped London top 4,000 Tuesday, but a weak start on Wall Street caused nerves elsewhere, leaving the blue chip index with just a narrow lead and back below the big figure.

London had traded up near 4,040 earlier as Barclays rallied on talk that the bank is listening to offers for its entire asset management arm, Barclays Global Investors. Better than expected quarterly results from Goldman Sachs also helped.

Lloyds Banking and Royal Bank of Scotland (RBS) both advanced after the US finance giant reported a pre-tax profit of $2.6bn for the quarter to March 27, compared with a loss of $3.6bn over the preceding three-month period. It also plans to raise $5bn (£3.4bn) in a share sale to pay off US government bail-out funds.

News that a number of number of local parties are sniffing around its Pakistan business was an extra boost for RBS. Pakistan's biggest bank MCB confirmed its interest, while Pakistani financial services company Jahangir Siddiqui and Habib Banks are also in the running.

HSBC was another bank on the rise after confirming it’s contemplating selling off three of its major office buildings.

Legal & General and Standard Life led the insurers after recent comments from investment analysts that the sector sell-off has been overdone.

Miners were shown the way ahead by Vedanta after an upgrade by Barclays Capital. Kazakhmys, Xstrata and Rio Tinto followed. Elsewhere in the resource sector, however, oils are out of fashion, with BP, BG Group and Tullow the big fallers. US crude oil futures fell on Monday by over $2 after the International Energy Agency cut its forecast for global oil demand. Friday’s EIA report said global demand for oil would decrease by a further 1m barrels this year. Demand is now expected to be around 2.4m barrels a day below 2008 levels.

Fund manager BlueBay remained the best performing FTSE 250 stock after Citigroup upgraded it from ‘hold’ to ‘buy’.

Hope that a UK car scrapping scheme will boost demand for cars caused UK-listed car dealers Pendragon, Lookers and Inchcape to surge. The government may give motorists £2,000 if they trade in their old car for a new one.

While the US is braced for a big week of company results, second-line stocks dominated the corporate news scene in the UK.

Soft drinks firm Britvic announced the successful refinancing of its committed bank facility, which will see its new six-bank £283m revolving multi-currency facility mature in May 2012. Prior to the commencement of this facility, effective from May 2010, Britvic will have access to increased committed bank facilities of £333m.

JKX Oil and Gas is to buy a 25% interest in the Veszto exploration licence held by Hungarian Horizon Energy. Oil and gas explorer JKX is paying for the stake by contributing its share of the drilling costs on the first well and by paying some of the previously incurred exploration costs. JKX expects the cost in the next quarter to be around $3.25m.

Dart Group, the aviation and distribution firm, expects full year results to be ahead of current market expectations due to strong trading performance and the strength of the US dollar.

Oil and gas explorer and producer Leni Gas & Oil reported a slight dip in production between February and March as it underwent development programmes at its operations in Spain, Hungary and Trinidad.

Stockbroker Jarvis Securities said given the current strong trading it has decided to declare a first interim dividend for 2009 of 3p per share.

John Perriss, the independent non-executive director of The Local Radio Company has recommended shareholders reject the offer from the UKRD Group as it compares unfavourably to the rival offer from Hallwood.

--------------------------------------------------------------------------------

The SG Turbos Trading Challenge 2009

Month Two starts today! Enter our risk free, real-time virtual turbos game, for your chance to battle against other traders to win fantastic prizes. The game runs until Friday, June 12th 2009 and you can join in at any time. Click here to enter the arena, today!

--------------------------------------------------------------------------------

FTSE 100 - Risers

Vedanta Resources (VED) 1,008.00p +15.40%

ICAP (IAP) 388.50p +13.18%

Legal & General Group (LGEN) 54.50p +11.68%

Lloyds Banking Group (LLOY) 87.90p +10.57%

Kazakhmys (KAZ) 513.50p +10.19%

Barclays (BARC) 195.50p +10.14%

Xstrata (XTA) 613.50p +7.16%

Eurasian Natural Resources (ENRC) 553.50p +6.14%

Man Group (EMG) 252.00p +6.11%

Antofagasta (ANTO) 590.00p +5.92%

FTSE 100 - Fallers

British American Tobacco (BATS) 1,495.00p -4.78%

BAE Systems (BA.) 323.00p -4.15%

Inmarsat (ISAT) 485.25p -3.72%

Reed Elsevier (REL) 460.25p -3.21%

Imperial Tobacco Group (IMT) 1,430.00p -3.18%

Capita Group (CPI) 617.50p -2.83%

Shire Plc (SHP) 803.00p -2.78%

Morrison (Wm) Supermarkets (MRW) 243.25p -2.70%

Pennon Group (PNN) 420.75p -2.43%

Cobham (COB) 178.10p -2.41%

FTSE 250 - Risers

BlueBay Asset Management (BBAY) 161.50p +25.19%

Ferrexpo (FXPO) 77.00p +16.67%

Enterprise Inns (ETI) 113.75p +16.07%

Inchcape (INCH) 15.25p +15.09%

Intermediate Capital Group (ICP) 453.00p +12.83%

Aricom (ORE) 30.50p +10.91%

Logica (LOG) 73.00p +10.19%

Derwent London (DLN) 845.00p +9.74%

Ashtead Group (AHT) 59.00p +9.26%

Shaftesbury (SHB) 361.00p +9.15%

FTSE 250 - Fallers

Premier Foods (PFD) 32.75p -5.76%

Domino's Pizza UK & IRL (DOM) 213.25p -5.22%

JKX Oil & Gas (JKX) 216.25p -5.15%

TR Property Investment Trust Sigma Shares (TRYS) 47.00p -4.57%

Debenhams (DEB) 55.00p -4.35%

Micro Focus International Plc (MCRO) 319.00p -3.63%

Soco International (SIA) 1,125.00p -3.60%

Homeserve (HSV) 1,251.00p -3.47%

William Hill (WMH) 188.50p -3.46%

SThree (STHR) 200.00p -3.38%

--------------------------------------------------------------------------------

IX Expo 09 – Focus on Forex Trading – Register Free Today

IX Expo returns to ExCeL on Friday, 24th April for a full day of seminars and live trading tuition. Discover the latest tools and skills to help you achieve your trading goals. Also, apply to win a free ticket to a full day course by VectorVest, Inc. on Saturday, 25th April. For tickets and details on both events, Click Here

--------------------------------------------------------------------------------

US Market

Stocks Seeing Some Volatility But Remain Mostly Negative

After moving sharply lower earlier in the session, stocks have seen some volatility over the course of morning trading on Tuesday. Nonetheless, the major averages have all remained stuck in negative territory.

The initial weakness came as traders reacted to a report from the Commerce Department showing that March retail sales unexpectedly fell by 1.1 percent. Economists had been expecting retail sales to increase by 0.3 percent.

Selling pressure waned not long after the open, however, and the major averages moved well off their worst levels of the day in the mid-morning trading. With the recovery attempt, the Dow climbed back above the 8,000 level.

Nonetheless, the major averages have moved back to the downside since then, reflecting continued weakness among real estate, tobacco, banking and airline stocks. On the other hand, some healthcare and trucking stocks are posting strong gains.

The major averages are currently posting notable losses, although they remain off their worst levels of the day. The Dow is currently down 81.48 at 7,976.33, the Nasdaq is down 18.05 at 1,635.26 and the S&P 500 is down 9.14 at 849.59.

--------------------------------------------------------------------------------

Selftrade

Open a Selftrade Dealing account, pay a flat £12.50 per trade Deal in UK and International Equities, Funds, Bonds, Covered Warrants and Listed CFDs. Instant account funding via debit card. No account or inactivity fees. No dealing fee on fund purchases. Click here for more information.

--------------------------------------------------------------------------------

European Market

Banks head advance

Strong banks and miners gave European bourses a lift Tuesday, with better results from Goldman Sachs sparking interest in bombed out finance plays.

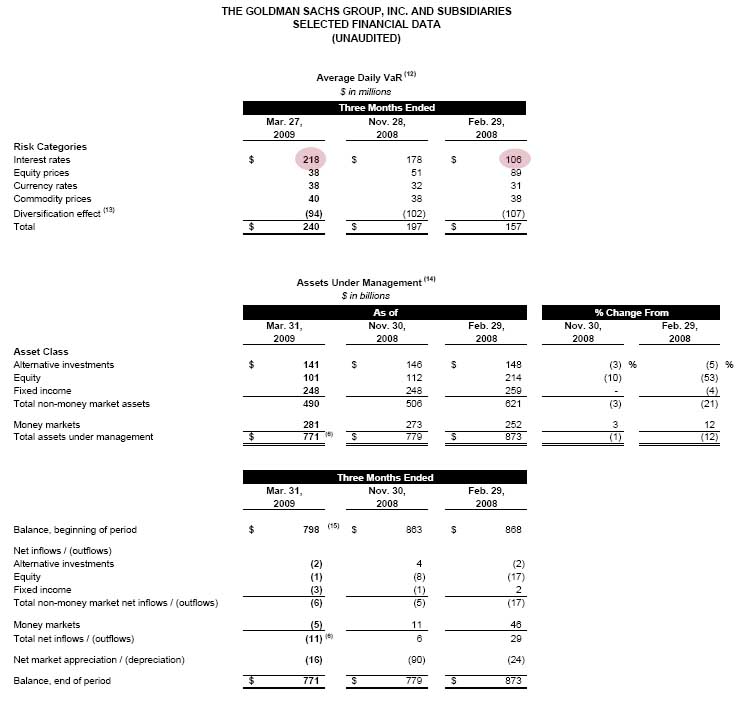

Goldman Sachs posted first quarter earnings ahead of expectations and announced plans to raise $5bn (£3.4bn) in a share sale to pay off US government bail-out funds.

BNP Paribas, Societe Generale, Banco Santander, Credit Suisse, Deutsche Bank and Natixis, surged on the back of the news.

Across the markets, the French CAC rose 26 to 3,000, Frankfurt added 65 to 4,557, while the Swiss exchange closed up 28 at 5,099.

Dutch consumer electronics giant Philips saw losses of €57m during the first three months of the year but said there will be no more job cuts.

The loss compares with a profit of €294m in the same period last year. Sales at the group fell 17% to €5.1bn as the economic downturn curbed consumer demand for electronic goods. The group said savings would exceed €500m by the end of 2009

Spyker Cars skidded lower after the luxury sports car maker said it needs additional funding this and next year to continue operations.

CAC 40 - Risers

Credit Agricole (ACA) € 10.69 +9.03%

BNP Paribas (BNP) € 38.50 +8.93%

Dexia (DEXB) € 3.03 +8.40%

AXA (CS) € 11.60 +7.01%

Saint Gobain (SGO) € 26.08 +6.67%

Air France-KLM (AF) € 9.05 +6.35%

Lafarge (LG) € 36.87 +5.58%

Societe Generale (GLE) € 36.90 +4.80%

Cap Gemini (CAP) € 26.68 +4.63%

Alcatel-Lucent (ALU) € 1.68 +4.28%

CAC 40 - Fallers

Vivendi (VIV) € 19.74 -4.24%

Essilor International (EI) € 30.29 -3.57%

Veolia Environnement (VIE) € 17.00 -3.46%

Carrefour (CA) € 29.17 -2.91%

Danone (BN) € 36.09 -2.85%

Sanofi-Aventis (SAN) € 40.82 -2.23%

Total (FP) € 36.34 -1.94%

Renault (RNO) € 22.30 -1.59%

France Telecom (FTE) € 16.63 -1.42%

Suez Environnement Company (SEV) € 11.75 -1.26%

--------------------------------------------------------------------------------

Welcome to the Spread Betting Trading Centre

If you’re new to Spread Betting, we provide a comprehensive introduction to this trading practice to get you up to speed. Click here

--------------------------------------------------------------------------------

Broker tips:

BlueBay, Hargreaves, Craneware

Fixed-income fund manager BlueBay Asset Management surged ahead Tuesday morning, rising by more than 20% on the back of an upgrade by Citigroup.

Citi changed its rating on the stock from ‘hold’ to ‘buy’ and upped its price target from 100p to 170p on expectations that earnings will start to improve in the second and third quarters of this year.

The US bank said: ‘We believe that now is the right time for the market to start looking forward to the upswing in earnings.’

Charles Stanley has upgraded its full-year profit forecasts for Hargreaves Services after the support services firm’s sparkling interim results.

The broker has upgraded its projected full-year 2009 profit before tax by 9% to £27.2m, and is predicting earnings per share (EPS) of 68.2p and a dividend of 12p.

EPS of 68.2p would mean the company is trading on 5.9 times 2009 earnings which in the opinion of Charles Stanley under-values the group.

‘Hargreaves is attractive in the current market as it enjoys significant visibility in its operations with long term contracts with blue chip clients. Weakness in its bulk material contract businesses is offset by favourable trading in other parts of the group,’ the broker notes.

Charles Stanley has maintained its ‘buy’ recommendation, though it notes that the company’s stated intention to contemplate a move from AIM to a full-listing may cause ‘some volatility to the short-term share price.’

The broker has a 559p price target for the stock, up from its previous target of 405p.

Broker KBC Peel Hunt has reiterated its ‘buy’ recommendation on Craneware after the hospital management software supplier revealed details of a tie-up with a US group purchasing organisation.

The broker said Cranware’s deal with Premier Purchasing Partners will introduce pre-negotiated pricing and terms for Craneware’s products to Premier’s 2,100 member and client hospitals.

The alliance will open the door for Craneware to ‘a significant part of the market that it does not currently sell into,’ while making tougher for competitors to get a foothold.

However, the ‘impact of this agreement will take time to build,’ KBC said, and thus the broker has left its 2009 profit forecasts unchanged.

-

- Similar Topics

- Replies

- Views

- Last post

-

- 1 Replies

- 13916 Views

-

Last post by yasmin

-

- 0 Replies

- 15318 Views

-

Last post by Paisa

-

- 16 Replies

- 2828 Views

-

Last post by GAMES

-

- 7 Replies

- 1382 Views

-

Last post by X.Playa

-

- 16 Replies

- 2669 Views

-

Last post by Twist

-

- 0 Replies

- 1349 Views

-

Last post by Daanyeer

-

- 0 Replies

- 2849 Views

-

Last post by Tanker

-

- 2 Replies

- 952 Views

-

Last post by JSL3000

-

- 3 Replies

- 446 Views

-

Last post by Demure

-

- 13 Replies

- 1311 Views

-

Last post by Thuganomics